On May 15th, Kaixia released its fourth quarter financial report for the 2023 fiscal year ending on March 31, 2024. Prior to this, Samsung, SK Hynix, Micron, and Western Digital had all released their latest financial reports for the year, sending a good signal to the storage market. Looking ahead to the future, how will the storage market develop?

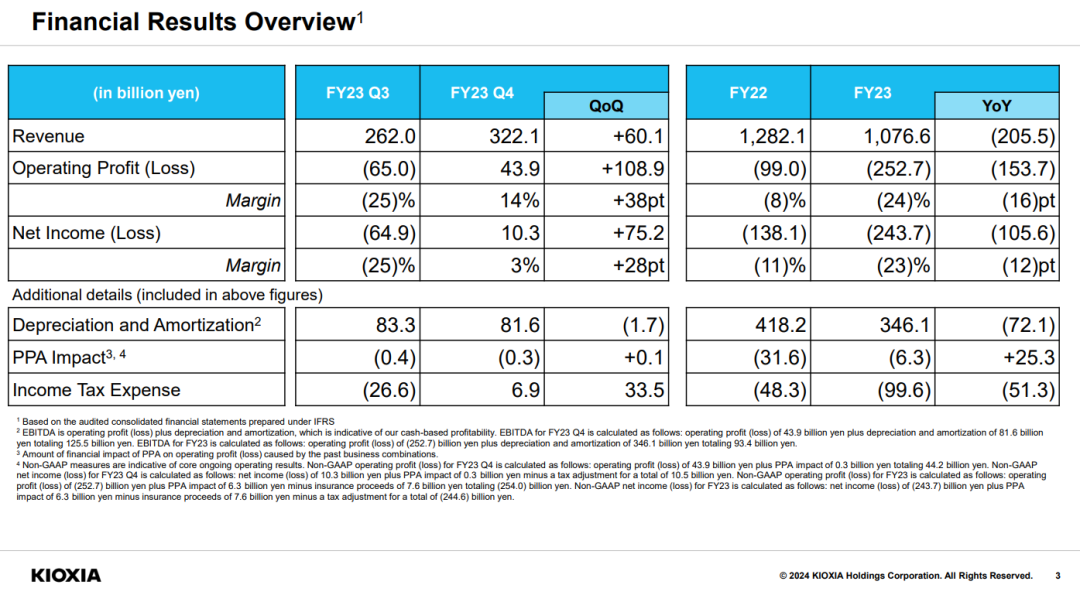

This quarter, Armor Hero's revenue was 322.1 billion yen, an increase of 60.1% compared to the previous quarter, achieving an operating profit of 43.9 billion yen and a net profit of 10.3 billion yen, both of which turned losses into profits compared to the previous quarter.

For the performance of the season, Kaixia stated that due to the improvement of market supply and demand balance, the company's revenue increased with the growth of average selling price (ASP) of products, and the ASP based on US dollars rose by about 20% in the quarter. Meanwhile, with the support of an increase in ASP and a decrease in inventory value loss, Kaixia has returned to a profitable state.

This season, Kaixia launched a new generation of UFS 4.0 embedded flash memory products and began producing the eighth generation BiCS FLASH using CBA technology to improve product performance and cost-effectiveness. In addition, Kaixia also demonstrated its strength in the fields of data centers and enterprise SSDs.

Looking ahead, Kaixia believes that the balance between supply and demand will continue to improve, with sales prices rising. Flash memory manufacturers will adjust production to cope with the growing demand in the smartphone and PC markets; Driven by PC and AI, the demand for SSDs, especially high-performance SSDs, will increase. Kaixia believes that the long-term growth potential of the SSD market will be greater than that of the NAND flash memory market; Kaixia will continue to optimize production and operating costs to respond to market changes and ensure profitability and company competitiveness.

Since 2024, driven by strong AI, the memory market has experienced strong development, especially for high value-added products such as HBM and DDR5. The market demand continues to rise, driving the growth of original factory performance. Except for Kaixia, other original manufacturers also announced impressive performance.

In the first quarter of this year, Samsung's Digital Solutions (DS) division, responsible for its semiconductor business, generated revenue of KRW 23.14 trillion and operating profit of KRW 1.91 trillion, achieving profitability for the first time since the fourth quarter of 2022. Among them, the storage business revenue was 17.49 trillion Korean won, a month on month increase of 11.3% and a year-on-year increase of 96.1%.

SK Hynix's revenue for the first quarter of this year was KRW 12.4296 trillion, with an operating profit of KRW 2.886 trillion and a net profit of KRW 1.917 trillion. SK Hynix achieved a turnaround from losses to profits in the fourth quarter of last year, and its operating profit in the first quarter of this year also reached its second highest level since the best market conditions in the same period in 2018.

Micron's financial report for the second quarter of fiscal year 2024 (as of February 2024) shows that it achieved revenue of $5.824 billion, a year-on-year increase of 58%, and a GAAP net profit of $793 million, successfully turning losses into profits.

Western Digital's revenue for the first quarter of this year was 3.457 billion US dollars, a year-on-year increase of 23%. Under Non GAAP accounting standards, Western Digital achieved a net profit of $210 million, also turning losses into profits.

03

Can the prosperity of the memory market continue?

It is worth noting that although the original manufacturers firmly believe in the power brought by AI and consumer electronics to the storage market, the industry believes that the rise in the storage market this time is not due to the comprehensive recovery of the terminal market, but more because the original manufacturers adjust production capacity according to market conditions, promote supply-demand balance development, and thereby improve profitability.

In terms of the terminal market, although HBM is developing rapidly under the AI wave, its production capacity and supply are insufficient, and the recovery of the consumer electronics market is not as expected as previously. Therefore, the industry is more cautious about the future storage market situation than the original factory.

However, due to the impact of the 403 earthquake in Taiwan this year, there have been sporadic reports in the market that PC OEM suppliers have accepted high contract price increases for DRAM and NAND Flash due to special considerations, but only sporadic transactions have occurred. By late April, after completing a new round of contract price negotiations, the increase in prices had widened compared to previous expectations, prompting global market research firm TrendForce to simultaneously revise up the second quarter DRAM and NAND Flash contract price increases. This not only reflects the buyer's desire to support the value of inventory on hand, but also includes considerations of the AI market outlook from both supply and demand sides. Jibang Consulting predicts that the quarterly increase in DRAM contract prices in the second quarter will be revised upwards to 13-18%; The quarterly increase in NAND Flash contract prices has been synchronously revised up to about 15-20%.

In terms of NAND Flash, Jibang Consulting emphasized that due to the uncertain recovery of consumer product demand, original manufacturers generally tend to be conservative in their capital expenditures for non HBM wafer production capacity, especially for NAND Flash whose prices are still at the breakeven point.

Hot News

Hot News