Driven by China's substantial investments in the semiconductor sector in recent years and its massive market, China's role in the global semiconductor landscape has become increasingly significant. While many international observers view China as an opportunity, they also harbor concerns about the potential threats posed by the rise of China's semiconductor industry. However, one thing is certain: Chinese semiconductor players have frequently appeared at prominent international conferences in recent years, generating considerable global influence.

Since China announced the establishment of a hundred-billion-yuan investment fund to challenge the dominance of global semiconductor leaders, industry giants have been contemplating and cautiously defending against China's semiconductor ambitions.

Considering China's vast domestic market, the technological "aptitude" of local players, its decades-long position as a leader in electronics manufacturing, and its recent in-depth explorations across various fields, it becomes clear why China places such high importance on developing its relatively lagging silicon industry.

According to our projections, by 2020, China will consume 55% of the world's memory, logic, and analog chips. However, only 15% of these will be produced domestically, representing an increase from the 10% share seen years ago. Nonetheless, the gap between supply and demand continues to widen.

China aims to play a significant role in the global semiconductor industry by producing more domestic microprocessor chips, memory, and sensors for locally manufactured consumer electronics such as smartphones and tablets, as well as industrial equipment. The goal is to meet the demands of the domestic electronics industry and even potentially export related components.

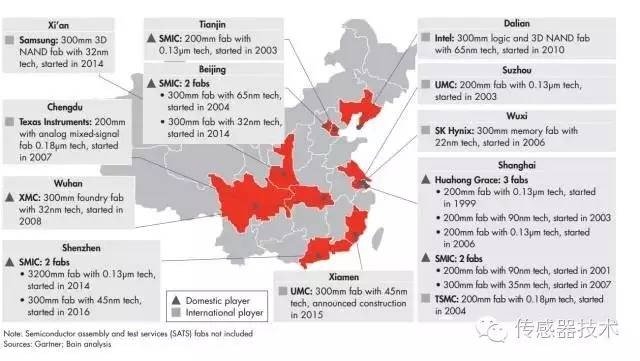

Guided by this objective, China has developed several semiconductor industry clusters nationwide (Figure 1). Over the next decade, national and local governments plan to invest an additional 720 billion yuan (108 billion USD) in the semiconductor industry. Besides addressing consumer and industrial needs, these investments will also cater to sectors such as communications and security, aiming to reduce reliance on international semiconductors.

Figure 1: National Distribution Map of China's Semiconductor Industry

However, based on our observations, the first obstacle to China's semiconductor rise is that most current projects involve partnerships with existing companies, chasing market leaders and laggards. Considering their goals, technological needs, and restrictions imposed by foreign governments, many Chinese companies have signaled their desire to invest more in multinational semiconductor companies. Recent frequent overtures have also yielded significant gains for China's semiconductor sector.

In January 2016, the Guizhou government funded the establishment of Huaxintong, a joint venture with Qualcomm focused on high-end server chip production, with the Guizhou government holding a 55% stake. Additionally, Tsinghua Unigroup invested 600 million USD in Taiwan's Powertech, becoming its largest shareholder.

Founded in 1997, Powertech is the world's fifth-largest packaging and testing service provider. U.S. memory manufacturer Kingston Technology is a significant shareholder, originally holding about 3.83% of shares and four board seats. Taiwan's Toshiba Semiconductor also holds one seat. Shareholdings and board seats are expected to change after the capital increase. Powertech primarily focuses on memory IC packaging and testing in its operations. This investment reflects Unigroup's and mainland China's determination in the memory industry.

Previously, Unigroup also attempted to acquire Western Digital and Micron, but these deals were ultimately thwarted by U.S. regulatory authorities. Despite these challenges, it is anticipated that China's semiconductor industry will initiate more mergers and acquisitions in the near future. We await these developments with keen interest.

For international semiconductor players, China's semiconductor ambitions can sometimes be daunting.

Given China's vast market, substantial capital, and long-term goals for economic growth, multinational corporations need to develop clearer strategies for their operations in China. However, this does not mean that global semiconductor players lack influence or bargaining power when engaging with China.

In fact, referencing China's past performance in entering new markets yields mixed results. Their state-owned companies and government organizations adopt different strategies based on competitors' situations and market conditions. Considering China's semiconductor goals and the challenges of entering international markets, it is likely they will continue to collaborate with multinational corporations while nurturing their own enterprises and industries.

China's Market Capture Strategies

Before understanding China's semiconductor merger and acquisition strategies, let's first examine its typical market entry approaches.

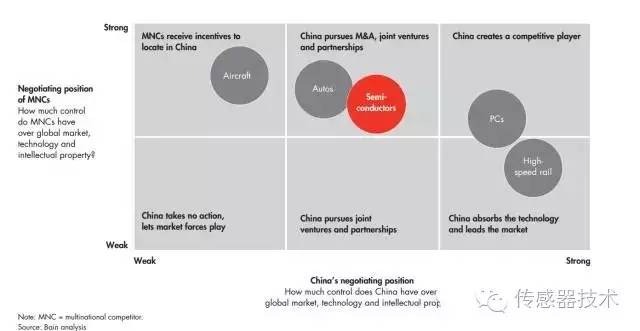

China's market entry strategies are consistently formulated based on the competitiveness of its domestic enterprises and various factors of international competitors, including technology, IP licensing, and global market influence (Figure 2).

Figure 2: China's Typical Competitive Strategy Matrix

To gain a favorable position in competition, China gradually seeks to control influential IP. Within this framework, the position of any industrial sector is not fixed; it changes with实际情况. Taking high-speed rail as an example, as some have noted, many of China's actions indicate they are accelerating the shift of the high-speed rail sector from the bottom-right quadrant in Figure 2.

Undoubtedly, China holds strong bargaining power in high-speed rail, enabling it to rapidly ascend to a market-leading position. While global demand for high-speed rail is not as intense, China has built an extensive high-speed rail network. It is believed that China will dominate the global rail market in the coming decade.

In China, the government can directly control procurement in entities类似 state-owned enterprises, and decisions within these sectors can impact domestic semiconductor adoption.

However, China cannot directly control consumer demand in industries like automotive. Multinational corporations with strong brands and technological advantages show little interest in sharing their IP with China. Faced with this situation, China tends to encourage foreign giants like Volkswagen and General Motors to invest in local production and establish joint ventures with Chinese companies. Decades after entering the Chinese market, GM and Volkswagen still hold leading positions.

In the aircraft sector, China's progress has been slower due to funding and technological constraints, coupled with limited assistance from Boeing and Airbus. Consequently, China's state-owned aircraft manufacturer—Commercial Aircraft Corporation of China (COMAC)—has delayed the launch of previously announced aircraft. While Airbus and Boeing have established offices in China, their activities involve low-IP-value operations such as assembly.

Setting these aside, let's return to the semiconductor business.

First, discussing the automotive electronics field, Chinese companies hold a relatively small share in this supply chain. Global consumers and businesses consider factors like quality, technology, value, and brand when selecting automotive electronic products. Therefore, to remain competitive, Tier-1 suppliers' systems and equipment, both in China and internationally, must choose chips that offer superior performance at acceptable prices.

For China to gain a larger market share in semiconductors, it must catch up with foreign competitors in both technology and price. China's ability to directly control procurement demand in state-owned enterprises and public institutions is a boon for its semiconductor development. However, due to its WTO membership, China must also engage in broader competition.

Challenges Facing China's Entry into the Global Semiconductor Market

For China's semiconductor industry, the first question to address when pursuing global market leadership is: where should the initial focus lie?

Memory? Logic chips? Analog chips? Fabless? Foundries or integrated business models?

Any of the above requires fundamental IP and innovation support, as well as talented engineers to drive progress. These factors are unique assets for market leaders but pose significant challenges for new players, even those with substantial funding.

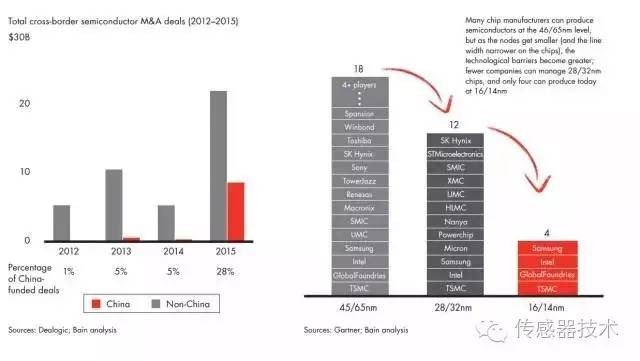

For instance, in cutting-edge process technologies, only a handful of leading players can keep up, bearing the talent and financial burdens required for the next steps in R&D and industry advancement (Figure 3). They have little incentive to share their latest technologies and IP with other potential global competitors, including Chinese companies.

Figure 3: China has been active in global semiconductor M&A since 2015 but lacks access to high-end technology.

Foundries:

Foundries pose a major challenge for China, especially for logic chip foundries, as they currently require advanced manufacturing processes. Even China's own fabless companies must rely on Taiwanese or foreign foundries to produce their chips after design.

Over the past few decades, companies like Samsung and TSMC have invested tens of billions of dollars in R&D to maintain their competitiveness.

The foundry model is particularly interesting, and China has built a robust ecosystem for low-cost devices such as smartphones and tablets.

Simultaneously, Chinese manufacturers have transitioned from assembly roles to system design, leveraging their cost-effective ecosystem to expand the global reach of these consumer devices. Many of these players do not require cutting-edge technology or manufacturing capabilities. For example, China's SMIC, while one or two generations behind advanced players like TSMC, adequately meets domestic demands.

Logic Chip Design:

Logic chips are a crucial area for China, not only for economic reasons but also from security and strategic perspectives. If China's logic chips become sufficiently advanced, they can enhance services in security-sensitive sectors such as national security, communications, and finance. Reducing reliance on U.S. or other foreign suppliers is highly desirable for China's semiconductor industry.

The emergence of Unisoc and HiSilicon has already enabled significant breakthroughs in the mobile sector for China.

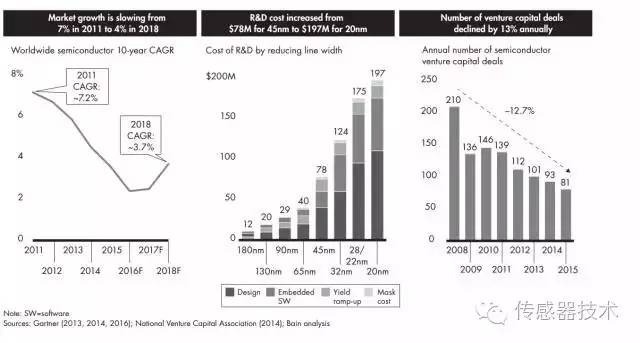

Meanwhile, Qualcomm and Intel are seeking ways to sustain growth in the logic chip sector, as they face challenges such as slowing growth and increasing R&D costs (Figure 4). Both companies have expressed strong willingness to collaborate with China.

Figure 4: Slow growth, rising R&D costs, and declining VC investment characterize the current logic chip industry.

In future data centers and the Internet of Things (IoT), logic chips will also play a vital role. New architectures such as FPGAs, GPGPUs, and reduced instruction set architectures like ARM and RISC-V offer different competitive advantages and pose varying threats to current market leaders.

However, we believe this may face difficulties, as China might push its own platform similarly to how it promoted TD-SCDMA in the past.

Memory:

The memory industry has undergone several shifts over the past few decades, from the U.S. to Japan, then to South Korea, and now potentially to China. China recognizes this pattern and hopes to establish a leading position in the memory field.

However, as in many other areas, Chinese companies lack technological advantages in memory. For instance, Wuhan Xinxin, in partnership with Cypress Semiconductor, announced a multi-year investment plan of $24 billion to increase its memory chip production capacity. In July of this year, Xinxin was also acquired by China's acquisition giant, Tsinghua Unigroup.

In 2016, Xinxin built a factory producing NAND Flash chips and plans to establish its first DRAM production facility.

However, according to our analysts, this significant decision will likely require an additional $35–50 billion over the next 8–10 years. Considering the technological gap between China and world-leading companies, we believe the failure rate of this investment remains high.

In the 1990s and early 2000s, Taiwan also attempted to enter the memory industry. The barriers to entry were much lower then, yet after burning through $40 billion, Taiwan's efforts ended in failure. Of course, we still hope China can achieve its goals.

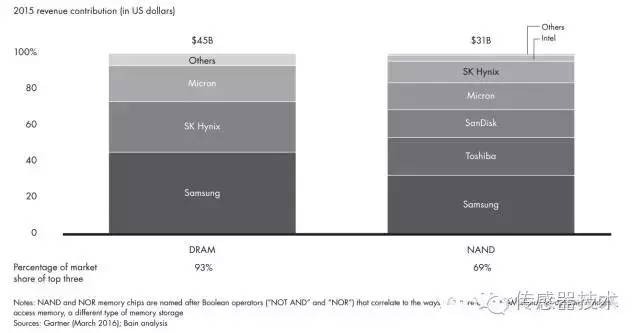

We believe a more cautious approach is advisable, as the DRAM market is currently稳固, while the NAND market is fragmented (see Figures 5 and 6). The NAND market is dominated by five major players. The emergence of 3D NAND may lead to industry restructuring, with some former leaders potentially losing their leading positions. Undoubtedly, next-generation memory technologies like 3D XPoint could disrupt the industry, offering opportunities for China. This also presents chances for China to invest in international players requiring substantial funding.

Figure 5: The DRAM market is solid, while the NAND market has only five major players.

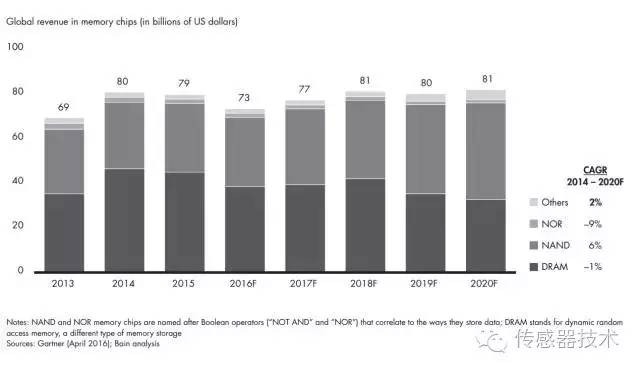

Figure 6: Memory Market Forecast

Analog Chips:

The rise of the Internet of Things (IoT) has spurred demand for sensors, power management chips, and signal processors, presenting opportunities for China in the analog chip market.

China's aggressive moves in electric vehicles and new energy have motivated international analog players to expand their presence in China. Given the industry's fragmented nature, China may have opportunities to selectively consolidate analog alliances. This also represents a significant opportunity for SMIC and other Chinese players.

SMIC has already invested in building a 200mm wafer fab focused on analog chips, preparing for the impending IoT boom.

How China and Foreign Companies Should Respond

China's intent to play a significant role in the global semiconductor industry is evident, and international semiconductor companies cannot stand idly by without resistance. For the latter, besides understanding China's position and choices, they should also consider the following:

Chinese semiconductor companies also have various options. Their guiding principle is to seek potential partners in the market to enhance their chances of success.

Conclusion

Driven by multiple factors, China's semiconductor industry faces unprecedented opportunities to build the status and ecosystem it has long desired in the semiconductor field. Success depends on the efforts and luck of the current generation of semiconductor professionals. As a Chinese person, I naturally hope for smooth progress. However, the semiconductor industry, with its high demands for technology, talent, and experience, cannot be developed overnight. We must recognize that while the prospects are bright, the road is曲折. I hope China's semiconductor professionals can persevere together.

Content excerpted from Sohu.

Hot News

Hot News