Currently, the technologies behind many cutting-edge digital devices we use rely on semiconductors. Due to the development of emerging technologies such as autonomous driving, artificial intelligence, 5G, and the Internet of Things (IoT), along with sustained investment in R&D and fierce competition among key market players, the global semiconductor industry is expected to experience steady growth over the next decade. Merger and acquisition activities in the semiconductor industry have peaked, with specialized vertical integration gradually becoming an industry focus. Japan and South Korea are striving to revitalize their domestic semiconductor industries through acquisitions, while ongoing trade wars and intellectual property disputes are expected to impede China's large-scale global investments. As demand for consumer electronics becomes saturated, growth in the semiconductor industry will gradually moderate. However, many emerging fields will present ample opportunities for the industry, particularly in automotive and artificial intelligence applications.

In this issue of Smart Insider, we recommend Deloitte's report titled "Semiconductors: Emerging Opportunities and Winning Strategies." It delves into the growth opportunities brought by automotive semiconductors and AI chips to the semiconductor market, offering new perspectives for local Chinese semiconductor industry participants as well as multinational companies seeking to enter the Chinese semiconductor market.

The Evolving Landscape of the Semiconductor Industry

Over the past few years, global semiconductor industry growth has primarily relied on demand for electronic devices such as smartphones and the expansion of technology applications like IoT and cloud computing. Total global semiconductor industry revenue is projected to increase from $481 billion in 2018 to $515 billion in 2019, with growth expected to continue into the next decade.

▲ Global Semiconductor Industry Sales Revenue (2016-2022, in billions of USD)

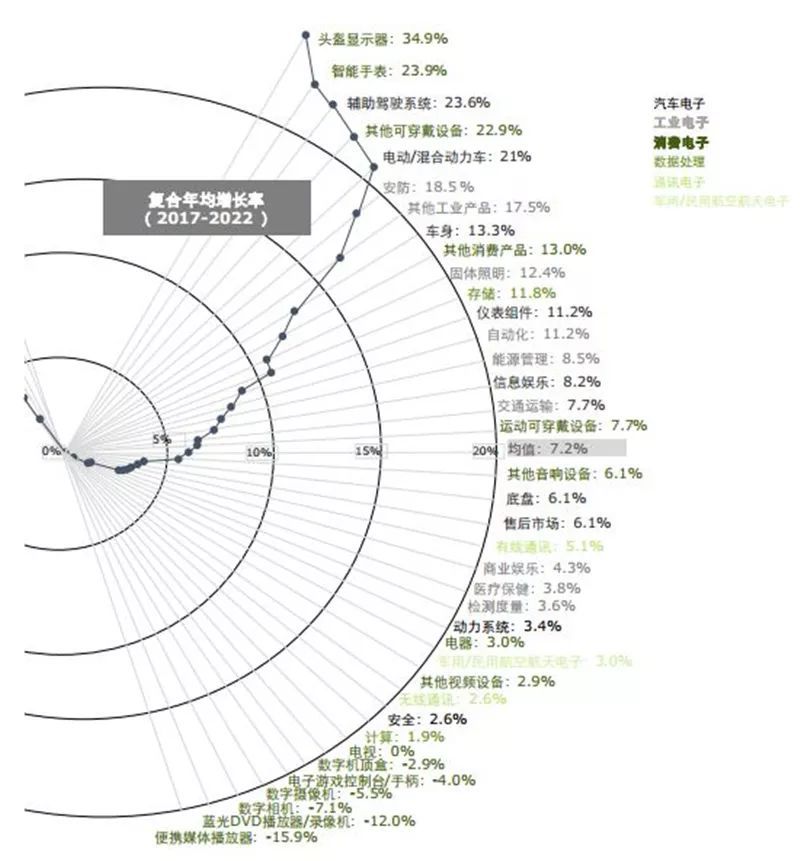

Automotive electronics and industrial electronics will become the two fastest-growing segments in the semiconductor industry, while revenue from consumer electronics, data processing, and communication electronics will grow steadily.

▲ Semiconductor Revenue Growth Rate by Electronic Device Category (2017-2022)

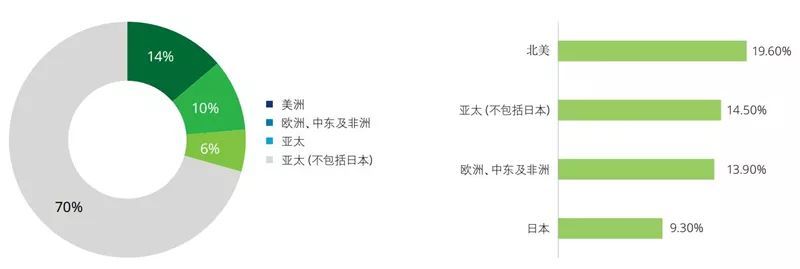

The Asia-Pacific region will remain the world's largest semiconductor consumer market. The increasing share of Chinese products is stimulating growth across the entire Asia-Pacific market and will provide a major driving force. Additionally, the increase in M&A activity will benefit the future development of the semiconductor industry.

▲ Regional Analysis of Semiconductor Industry Sales (2018)

In terms of growth, the U.S. market experienced the fastest growth in 2018, primarily due to the rise of dynamic random-access memory (DRAM) and high demand for microcontrol units (MCUs), especially in the memory device market. As memory prices increased and contributed significantly to revenue, the memory market developed rapidly, benefiting the Asia-Pacific region. China's integrated circuit (IC) industry grew by 24.8%, strongly driving the development of the Asia-Pacific regional market.

However, despite the significant improvement in the competitiveness of Chinese semiconductor manufacturers in recent years, key components still rely heavily on imports from Western countries, with a self-sufficiency rate of less than 20%. The Chinese government is highly concerned about this issue and has formulated several favorable policies to support the development of the semiconductor industry.

▲ Major Players in China's Semiconductor Industry

Overall, there are four types of enterprises in China's semiconductor industry: the "national team," the "local team," private equity/venture capital funds, and multinational corporations, all competing to propel China to become the driving engine of the global semiconductor industry.

Breakthrough in Automotive Semiconductors

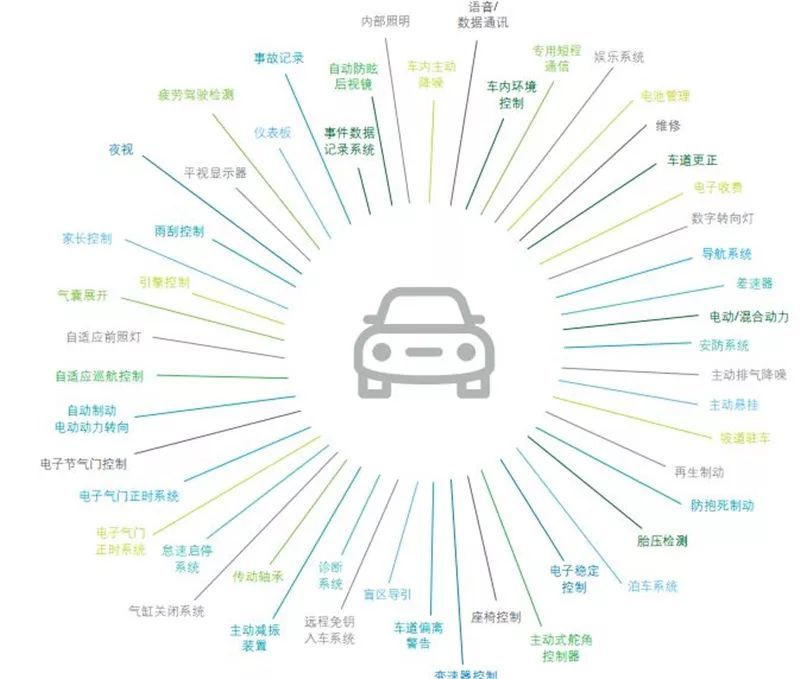

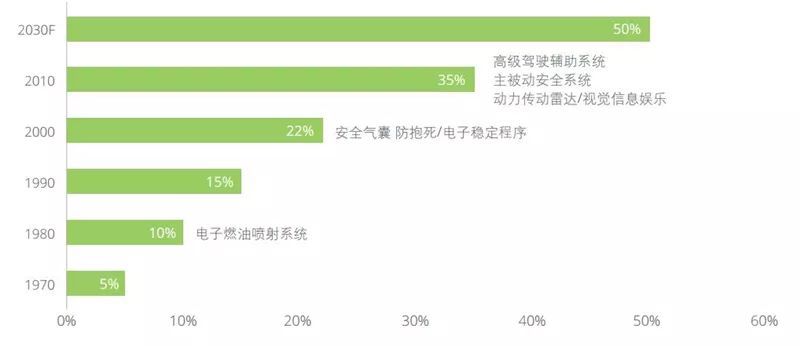

The automotive industry has undergone a long period of development to achieve the pre-installation of automotive electronics centered on safety and comfort. As early as 2004, only a quarter of vehicles leaving the factory had built-in airbags, and less than 50% were equipped with pre-installed power seats. However, driven by government regulations and consumer demand, safety-related electronic systems rapidly became widespread. Today, most innovations in the automotive industry occur at the electronic system level rather than the mechanical level. Between 2007 and 2017, the cost proportion of automotive electronics increased from about 20% to around 40%.

▲ Pre-installed Automotive Electronics

▲ The automotive industry has undergone a long period of development to achieve the pre-installation of automotive electronics centered on safety and comfort.

▲ Proportion of Electronic Systems in Total Vehicle Cost (%)

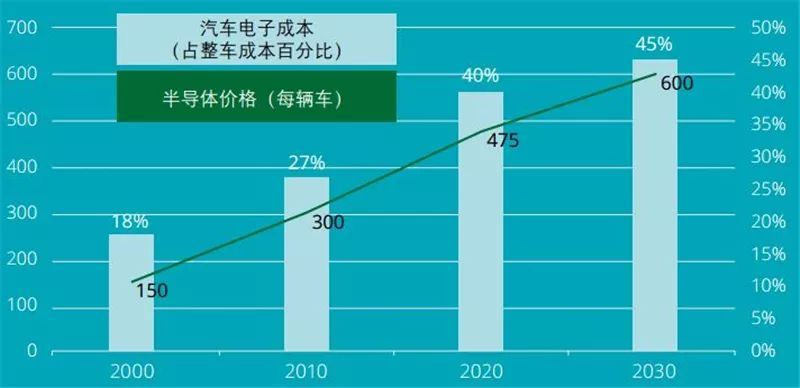

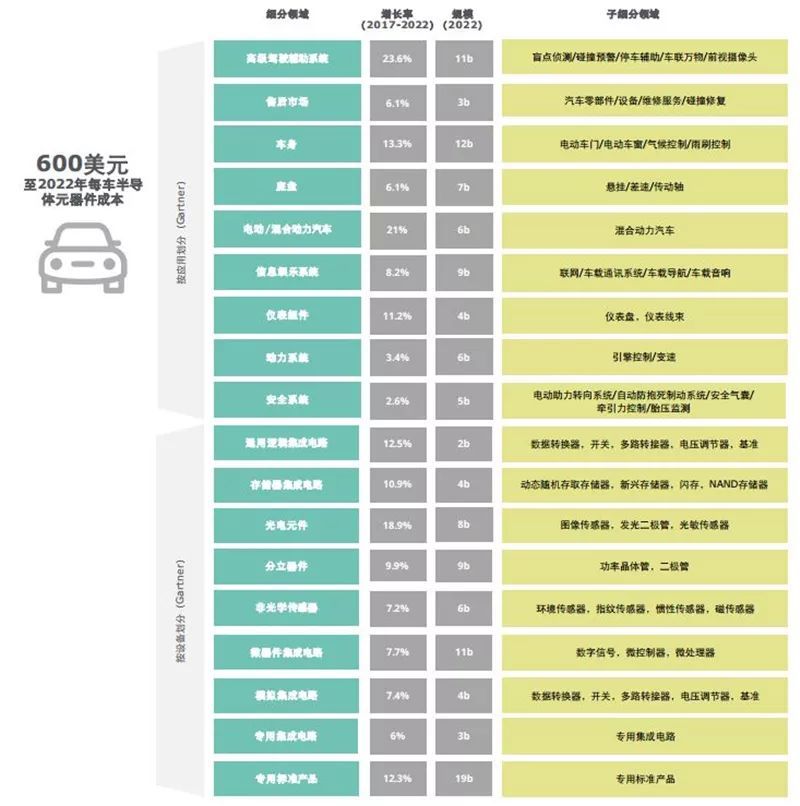

Semiconductor cost (i.e., the cost of electronic system components) has increased from $312 per vehicle in 2013 to about $400 today. Automotive semiconductor suppliers are benefiting from the significant rise in demand for various semiconductor devices such as microcontrol units, sensors, and memory. By 2022, semiconductor cost is expected to reach nearly $600 per vehicle.

▲ Automotive Electronics and Semiconductor Cost per Vehicle

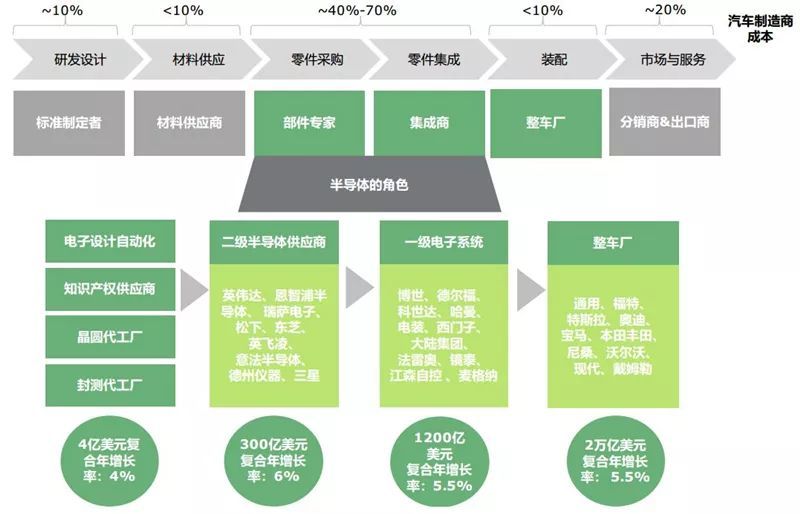

Semiconductor suppliers play a crucial role in the automotive industry supply chain. In the traditional automotive industry ecosystem, semiconductor suppliers sell products to Tier-1 electronic system suppliers, who then integrate the technology into modules delivered to OEMs for assembly. In recent years, the automotive industry has undergone tremendous changes, and the ecosystem will be completely transformed in the coming years. Factors such as the development of AI, electric vehicles, autonomous driving, energy storage, and cybersecurity; public social awareness of topics like safety and shared mobility; concerns about environmental issues like pollution; economic considerations such as infrastructure spending; and the growth of the Asian market will reshape the automotive industry.

▲ The Role of Semiconductors in the Automotive Ecosystem

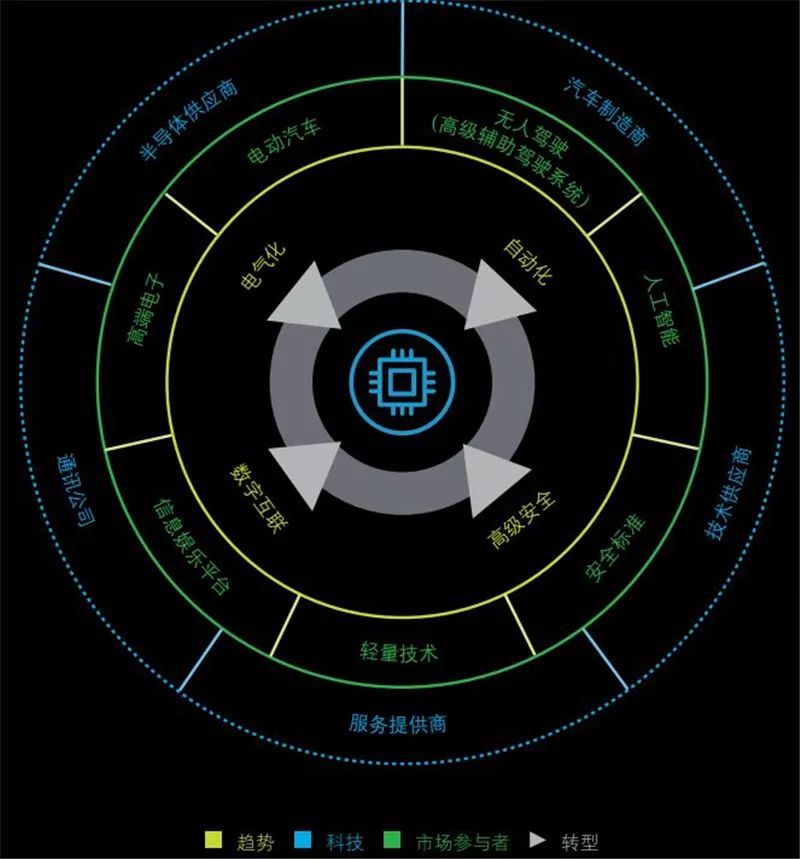

Automation, electrification, digital connectivity, and security: These four major trends will drive the continuous increase of semiconductor components in automotive electronics and subsystems over the next decade.

▲ Key Trends in Automotive Semiconductors

Although mobile phones are currently and will remain the largest market for semiconductor companies, growth in this field has been saturated for many years. The automotive semiconductor market is an exception. As electronic components like advanced driver-assistance systems (ADAS) and in-vehicle infotainment (IVI) are increasingly used in vehicles, strong demand in this area makes it an important growth market for semiconductor companies.

▲ Automotive Semiconductor Revenue and Production by Global Region

▲ Forecast for Automotive Semiconductor Application and Device Growth

The AI Chip Race Begins

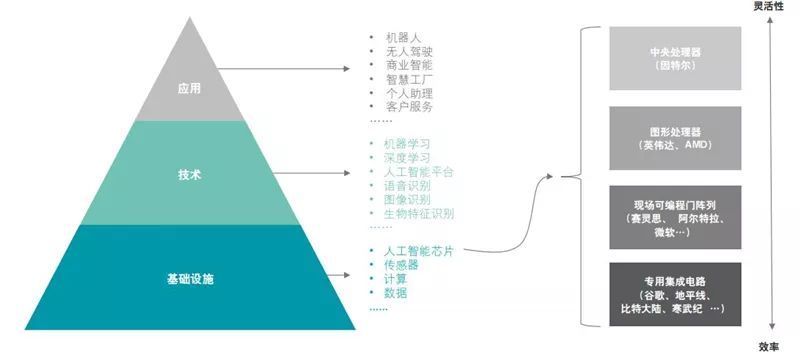

The AI framework can generally be divided into three layers. The infrastructure layer includes core AI chips and big data, which form the foundation for the sensing and cognitive computing capabilities at the technology layer. The application layer is at the top, providing services such as autonomous driving, intelligent robotics, smart security, and virtual assistants. AI chips are the core of the AI technology chain and are crucial for AI algorithm processing, especially deep neural networks.

"Depth" refers to the number of layers and nodes in a neural network model. In recent years, the complexity between layers and the number of nodes have grown exponentially, posing a significant challenge to computing power. Although traditional central processing units (CPUs) excel at handling general workloads—especially rule-based tasks—they now struggle to meet the parallel computing requirements of AI algorithms.

▲ The Role of AI Chips in Different Layers of AI

There are two main approaches to solving the parallel computing problem: first, adding specialized accelerators to existing computing architectures; second, completely redeveloping to create entirely new architectures that simulate the human brain's neural networks. The second method is still in early development and not suitable for commercial applications. Therefore, the primary method currently used is adding AI accelerators. Various types of AI chips can achieve acceleration, with mainstream accelerators including graphics processing units (GPUs), field-programmable gate arrays (FPGAs), and application-specific integrated circuits (ASICs), which include variants such as tensor processing units (TPUs), neural processing units (NPUs), vision processing units (VPUs), vector processing units (VPUs), and brain-inspired processors. Each type of AI chip has its own advantages and disadvantages.

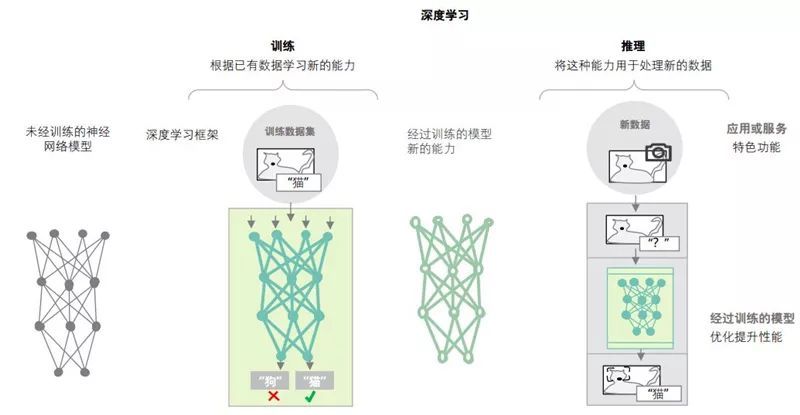

Deep learning has two entirely different AI deployment methods: training and inference. AI "trains" neural network models based on big data, using training datasets to obtain newly trained models. These newly trained models are then endowed with new capabilities to "infer" conclusions from new datasets.

Because the training phase requires applying massive datasets to neural network models, it demands substantial computing power. This requires high-end servers with advanced parallel computing capabilities to process large volumes of highly parallel diverse datasets. Therefore, this phase of work is typically completed using cloud-based hardware. The inference phase can be performed either in the cloud or using edge devices (products). Compared to training chips, inference chips need to more comprehensively consider factors such as power consumption, latency, and cost.

▲ Two Major Stages of Deep Learning

AI chip innovation has just begun, and suppliers adopt different approaches to chip acceleration. For example, Google has chosen the ASIC route, while Microsoft has demonstrated that using FPGAs can yield comparable or even better results. Meanwhile, Xilinx, Baidu, and Amazon are all working to reduce the traditional barriers to ASIC adoption.

By 2022, the AI chip market is projected to account for over 12% of the entire AI market, with a compound annual growth rate (CAGR) of 54%. The Americas region will lead the global AI market, followed by Europe, the Middle East, Africa, and the Asia-Pacific region. In 2022, the Americas region will dominate the market.

▲ Global AI and AI Chip Market (2022)

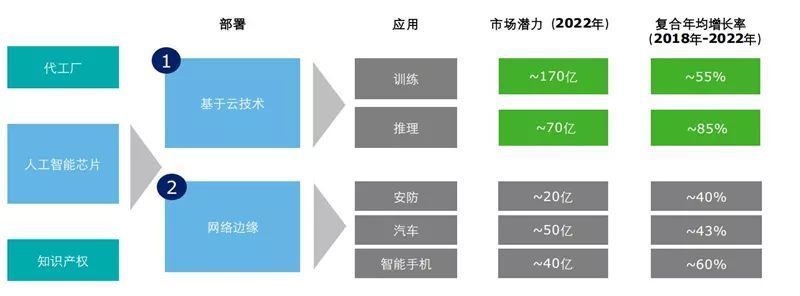

Based on deployment methods, the AI chip market can be divided into two segments: cloud-based and network edge.

▲ AI Chip Market Deployment

The cloud is the largest segment of the AI chip market, due to the continuous adoption of AI chips in data centers to improve efficiency, reduce operating costs, and enhance infrastructure management. Specifically, the AI training market is expected to reach approximately $17 billion, while the cloud inference chip market will reach $7 billion. In terms of product categories, GPUs have become the mainstream trend in AI chips, holding over 30% market share, higher than any other product category.

AI chips can be deployed not only in the cloud but also in various network edge devices, such as smartphones, autonomous vehicles, and surveillance cameras. AI chips applied to network edge devices are mostly inference chips and are becoming increasingly specialized. By 2022, the AI inference chip market is expected to grow to $2 billion, with a CAGR of 40%.

The continuous rise in product costs will benefit AI chip suppliers. For example, the cost of Apple's A11 chip increased to $27.50. The growing cost of AI chips will drive up smartphone prices, allowing smartphone manufacturers to generate more revenue. The application of AI chips has also expanded from high-end models to mid-range models, which could potentially bring more revenue to smartphone suppliers.

Autonomous driving is not only a complex AI application scenario but also highly significant. It is expected to strongly drive the application of AI inference chips, increasing the market size of AI inference chips to $5 billion, with a CAGR of 40%.

Sensing, modeling, and decision-making are the three essential processes in autonomous driving, each involving inference chip applications. Whether for environmental sensing or obstacle avoidance, autonomous driving places high demands on the computing power of AI chips.

With the support of AI technology, the intelligence of surveillance systems continues to upgrade. Over the past decade, the surveillance system industry has gone through three important transformation stages. First, the "high-resolution" stage, where systems could record ultra-high-definition video. Second, the "networked" stage, where systems achieved networking and interconnection.

M&A Activity Returns to Rationality

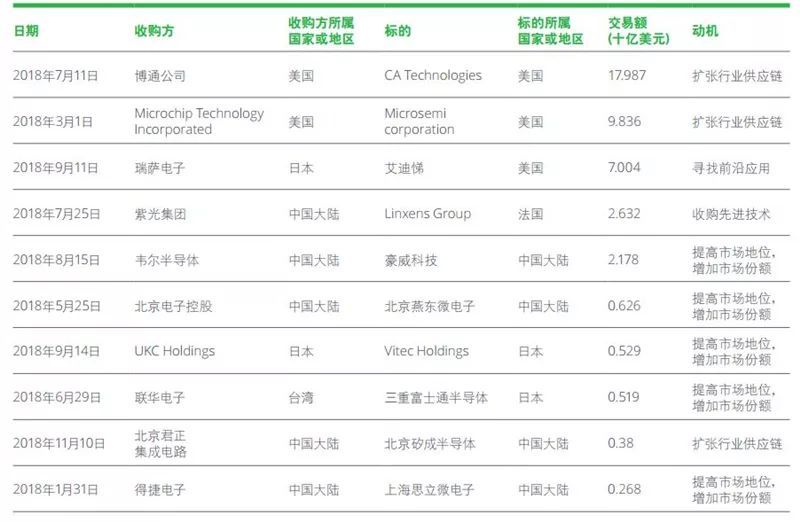

Semiconductor M&A activity has passed its peak, with automotive, AI, and network/data centers becoming the most popular emerging verticals. Japan and South Korea have been committed to revitalizing their domestic semiconductor industries, actively participating in acquisitions of mid-sized companies in the U.S. and Europe, and cooperating with China. At the same time, disputes surrounding intellectual property and national defense security issues will continue to inhibit the globalization process of Chinese companies. China's tightening of overseas investment in U.S. high-tech companies has become the new normal, leading to an overall contraction in the global M&A market. Nevertheless, large semiconductor conglomerates are still searching for potential targets with high market share and profitability across various verticals.

In 2016, global semiconductor M&A transaction value peaked at $120 billion. In 2017, M&A transaction value in the semiconductor industry fell sharply. Besides the reduction in acquisition targets due to previous transactions, tightened regulatory scrutiny in Europe and the U.S. was also a major factor. Due to increased single-transaction values, global M&A transaction value grew again in 2018. For example, Broadcom acquired CA Technologies for $17.99 billion.

▲ Global Semiconductor M&A Transactions (2014-2018)

▲ Top Ten Global Semiconductor M&A Transactions (2018)

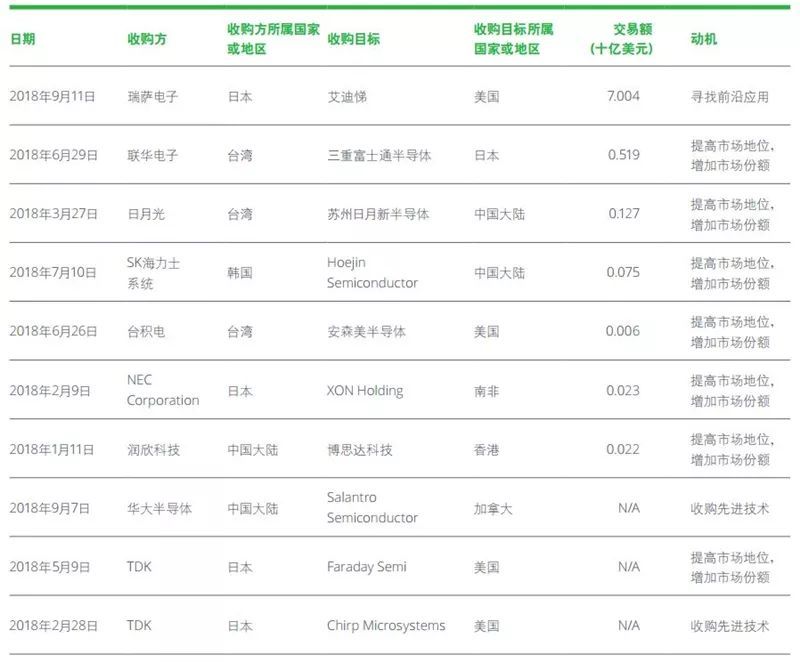

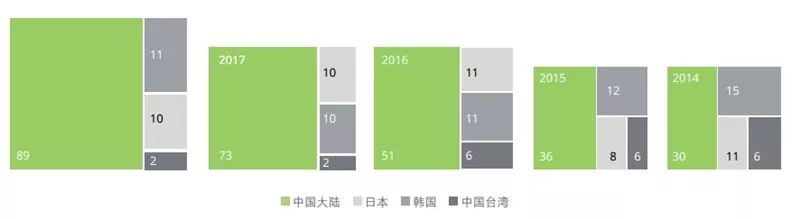

From 2014 to 2015, M&A transaction volume in East Asia (China, Japan, South Korea, and Taiwan, China) grew rapidly, with transaction value exceeding $22 billion. However, after several years of rapid expansion, M&A activity stagnated in 2017 and 2018. In 2017, semiconductor M&A transaction volume in East Asia declined by 1%, with transaction value growing by only 2%.

▲ M&A Transaction Value in Mainland China, Japan, South Korea, and Taiwan, China (2014-2018)

▲ Top Ten M&A Transactions in Mainland China, Japan, South Korea, and Taiwan, China (2018)

▲ Growth in Domestic M&A Transaction Volume—East Asia (2014-2018)

Over the past five years, the most important reason for the rapid development of China's semiconductor industry has been favorable government policies. China is currently the world's largest importer of semiconductor chips. The government's overall strategy is to reduce reliance on foreign imports and develop the domestic semiconductor industry foundation. This policy has prompted Chinese companies to enter the semiconductor industry and acquire advanced technologies through acquisitions.

Undoubtedly, mainland China is the most active region for domestic M&A activity in East Asia. From 2014 to 2018, the compound annual growth rate of M&A transaction volume reached 24%. For example, in 2018, Alibaba acquired Hangzhou C-Sky Microsystems Co., Ltd. Prior to this, Alibaba had already invested in five chip companies: Cambricon, Barefoot Networks, DeePhi Tech, Kneron, and ASR Microelectronics. Compared to mainland China, M&A activity in Japan, South Korea, and Taiwan, China has been relatively moderate. The main purposes of M&A transactions are to enhance market position, increase market share, and seek emerging applications.

Overall, since 2016, cross-border M&A transaction volume in East Asia has declined, especially after the U.S. intensified investigations into Chinese companies seeking cutting-edge technologies. In 2017, the White House released a report titled "Ensuring Long-Term U.S. Leadership in Semiconductors," which highlighted the potential threat of China's semiconductor policies to the United States and recommended that the U.S. government take measures to prevent or strictly restrict acquisitions by Chinese companies, while tightening regulatory restrictions on the flow of critical semiconductor intellectual property. However, despite increasingly stringent government M&A reviews, North America and Europe remain the primary M&A destinations for semiconductor companies in East Asia.

Smart Things believes that although the semiconductor industry has become saturated in traditional electronic device markets, it will experience explosive growth in emerging industries such as automotive electronics and artificial intelligence. By 2022, the cost of automotive semiconductor components will reach $600 per vehicle. Demand for automotive semiconductor devices such as microcontrol units, sensors, and memory will surge, and the cloud technology field will become the largest market for AI chips. China has already become a significant source of revenue for major global semiconductor manufacturers, with many companies deriving over half of their revenue from China. Multinational companies intending to enter the Chinese market should comprehensively consider multiple factors, including policy, technology, marketing, logistics, and global strategy.

This article is excerpted from Smart Things.

Hot News

Hot News