Against the backdrop of Sino-U.S. trade friction, the U.S. has dealt a heavy blow to ZTE, exposing the vulnerabilities in China's semiconductor industry. So, what is the current status of China's chip technology? Let me elaborate gradually.

The issue of chips can never achieve rapid development like the internet. Even with ZTE facing sanctions, everyone has seen the uncovered reality of China's technological state.

In this context, the stock price of Unigroup Guoxin shyly rose by 9.99%. The reason for saying "shyly" is that it took a whole day to achieve this 9.99% increase. Clearly, investors are cautious about this issue.

Why the caution? Because chip technology is not a model China is adept at—rolling up sleeves and getting to work. It's not a problem that can be solved with sheer determination. People often mention the "Two Bombs, One Satellite." How many of those were produced? Could they achieve mass production? Clearly not. So, what are the challenges in mass production? First, the industrial foundation; second, talent reserve. Unfortunately, China currently lacks both. Regarding the current situation, the industrial foundation has largely been undermined by real estate, and talent reserve has been largely absorbed by the internet.

Chip manufacturing is primarily divided into three major segments: wafer fabrication, front-end chip processing, and back-end chip packaging.

The most technologically challenging and core segment is front-end chip processing, which involves hundreds of process steps, each with corresponding equipment. Among these equipment, lithography technology presents the greatest technical difficulty.

China's semiconductor technology is mainly concentrated in the first and third segments. Most of the technological equipment in the second segment remains空白, so high-end chips entirely require imports.

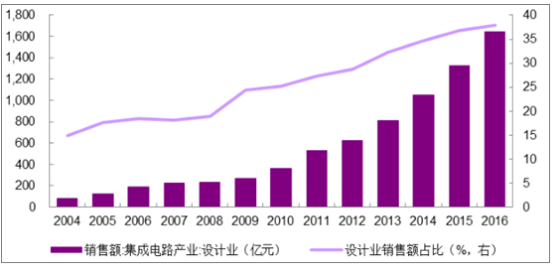

China's chip design industry continues to maintain rapid growth. In 2016, the total sales of China's design industry reached RMB 164.43 billion, a 24.1% increase from 2015, surpassing the packaging and testing industry for the first time to become the largest segment in China's integrated circuit industry chain.

Sales Revenue and Proportion of China's Semiconductor Design Industry

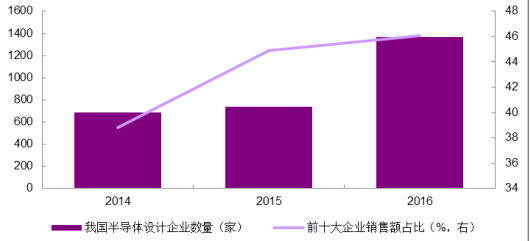

High-quality companies have emerged, but industry concentration still has room for improvement. In 2016, there were 1,362 IC design companies in mainland China. The combined sales of China's top ten design companies reached RMB 70.015 billion, accounting for 46.1% of the industry's total sales, up from 23.8% in 2014. However, compared to the nearly 90% concentration in the U.S., China's concentration is significantly lower, leaving considerable room for improvement.

Large Number of IC Design Enterprises in China

China's Top Ten IC Design Companies in 2016

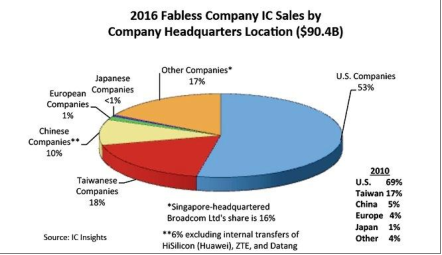

Some domestic enterprises already possess strong international competitiveness. The number of IC design companies in mainland China increased significantly from 736 in 2015 to 1,362 in 2016. In terms of pure-play design firms, only Shenzhen HiSilicon from mainland China made it into the global top 50 in 2009. By 2016, 11 companies, including HiSilicon, Spreadtrum, and ZTE Microelectronics, had entered the list. The combined sales of China's pure-play IC design firms accounted for 10% of the global total in 2016, up from 5% in 2010.

Global Pure-Play Design Company Sales Proportion in 2016

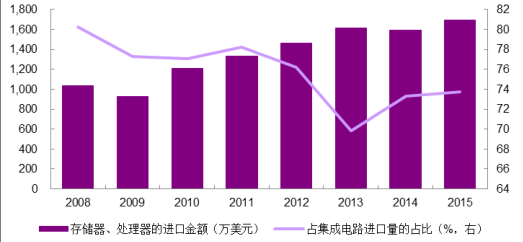

While recognizing progress, it's also necessary to acknowledge the gaps. Currently, China lacks high-end IC design capacity. China's chip design industry covers nearly all product categories, and some products have achieved a certain market scale. However, China's chip products are generally still in the mid-to-low end and cannot compete with foreign products in the high-end market. Of China's annual integrated circuit imports exceeding $200 billion, processors and memory chips account for over 70%.

Over 70% of China's Integrated Circuit Imports Are Memory and Processors

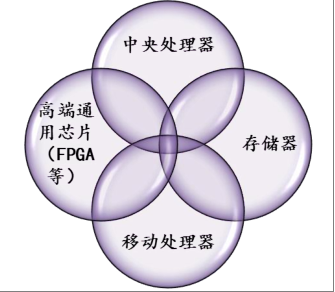

High-end general-purpose chips lag significantly behind foreign advanced levels, mainly in four aspects. 1) The gap in mobile processors is relatively small. Unisoc and HiSilicon have entered the global forefront in mobile processors. 2) Central Processing Units (CPUs) are the most challenging high-end chips to catch up with. Intel almost monopolizes the global market. There are about 3-5 related domestic enterprises, but none have achieved commercial mass production; most still rely on research project funding and government subsidies to operate. Although domestic CPU design companies like Loongson can produce CPUs and may surpass foreign CPUs in single or partial indicators, they cannot compete with dominant products due to a lack of industrial ecosystem support. 3) The gap in memory is also significant. Wuhan Yangtze Memory Storage is attempting to develop 3D Nand Flash (flash memory) technology, but it is currently only at the sample stage of 32-layer flash memory, while global leaders like Samsung and Intel have begun mass-producing 64-layer flash memory products. 4) For high-end general-purpose chips like FPGAs and AD/DA, the technological disparity between domestic and foreign products is substantial.

The Technological Gap Between Domestic and Foreign Products Is Mainly in Four Areas

In response to the current state of China's semiconductor design industry, the development focus should be on creating independent CPUs and security products for national information and social security; developing high-end integrated circuits for mobile communications and smart TVs; and creating specialized products and IP for specific fields such as security, automotive, and smart grids.

Chip design is at the very上游 of the semiconductor industry, serving as its most core foundation. It involves极高的技术壁垒, requiring substantial human and material investments and long-term technological accumulation and experience沉淀. Currently, domestic companies still lag significantly behind foreign companies in key areas like CPUs, making rapid catch-up difficult in the short term. However, looking at industrial development in recent years, the technological gap is gradually narrowing. Meanwhile, with the nation strongly advocating for semiconductor development, achieving chip国产化 can be anticipated step by step.

Hot News

Hot News