According to foreign media reports, under pressure from the United States, China will launch a large-scale plan to support its semiconductor industry in order to achieve self-sufficiency in chips. Sources have revealed in detail China's next steps.

According to foreign media reports on Tuesday (December 13th), three sources said that China is developing a support plan worth over 1 trillion yuan (143 billion US dollars) to support the development of the semiconductor industry.

According to sources, this is one of the largest fiscal incentive plans planned by the Chinese government within the next five years, mainly to support domestic semiconductor production and research and development through subsidies and tax credits.

Analysts say that China's move may further alert the United States and its allies to China's competition in the semiconductor industry.

Two anonymous sources said that the plan could be implemented as early as the first quarter of next year. They said that most of the financial aid will be used to subsidize Chinese companies in purchasing domestic semiconductor equipment, mainly semiconductor manufacturing plants or factories. All three sources indicate that these companies will be entitled to a 20% subsidy on procurement costs.

According to sources, through this incentive program, the Chinese government aims to strengthen support for Chinese chip companies to establish, expand, or update domestic manufacturing, assembly, packaging, and research and development facilities. They said that Beijing's latest plan also includes implementing tax incentives for the semiconductor industry.

Reuters reported that the United States has cracked down on companies including Yangtze Memory Technology Co., Ltd. (YMTC) and SMIC, and advanced artificial intelligence chip manufacturers have also stopped supplying Chinese companies and laboratories.

On December 12th, the Chinese Ministry of Commerce announced that China has filed a lawsuit against the United States' chip export control measures at the World Trade Organization (WTO), accusing the United States of "abusing export control measures" to obstruct the normal international trade of chips and other products, and stating that this "threatens the stability of the global industrial and supply chains".

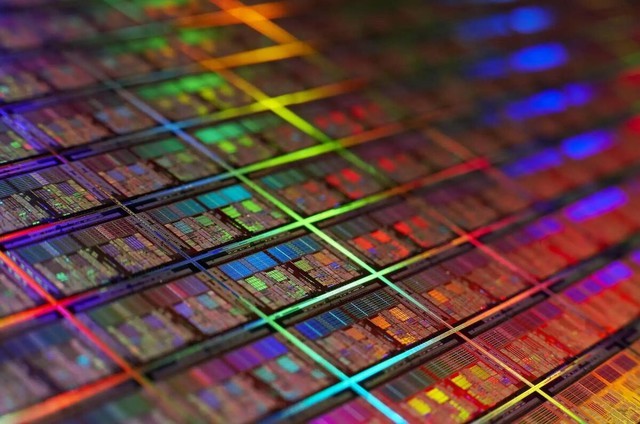

China has long lagged behind other countries in the field of chip manufacturing equipment, which is still dominated by companies from the United States, Japan, and the Netherlands. Although there have been some Chinese companies catching up in the past 20 years, most of them still lag behind their competitors in terms of their ability to produce advanced chips.

For example, NAURA's etching and thermal processing equipment can only produce chips of 28 nanometers and above, while Shanghai Microelectronics Equipment Group (SMEE) is the only lithography company in China that can produce chips of 90 nanometers, far behind ASML in the Netherlands, which produces chips as small as 3 nanometers.

Sources indicate that the beneficiaries of China's new subsidy program will be state-owned and private enterprises in the industry, particularly large semiconductor equipment companies such as NAURA, China Advanced Micro Processing Equipment Company, and Kingsemi.

There are reports that some Chinese chip stocks in Hong Kong have seen a significant increase after the implementation of the plan. SMIC's increase exceeded 8%, bringing its daily growth rate to nearly 10%. Huahong Semiconductor Co., Ltd. closed up 17%.

Hot News

Hot News