On June 6th Beijing time, artificial intelligence chip giant NVIDIA's market value reached $3.01 trillion, surpassing Apple to become the world's second largest company after Microsoft, opening a new chapter in the market value reshuffle of Wall Street giants. Microsoft's market value is $3.15 trillion, while Apple's market value is $3.0 trillion。

At 3:12 am, Nvidia's stock price soared to $1222.99, with a market value exceeding $3.0053 trillion, surpassing Apple for the first time in history.

Market value trends of Apple and Nvidia in 2024

At the same time, as co-founder and CEO of Nvidia, Huang Renxun's value has also skyrocketed. His net worth has exceeded $100 billion, and according to real-time data from Forbes and Bloomberg, Huang Renxun ranks 13th. But it still lags behind figures such as Bill Gates, Jeff Bezos, and Elon Musk.

Nvidia's second quarter revenue forecast released on May 22 exceeded market expectations and announced a stock split plan (1 split 10). This series of positive news has doubled investors' confidence and encouraged them to continue betting on this leading company in the field of artificial intelligence. Since then, Nvidia's stock price has risen by nearly 20%, and this year it has risen by as much as 150%. In 2023, Nvidia's stock price leads the S&P 500 index with a 238.9% increase.

Among this year's "Big Seven" technology giants, Nvidia is undoubtedly the company with the most outstanding performance, while Meta's stock followed closely with a 35.6% increase. However, Tesla's stock has become a clear exception in terms of earnings and valuation, with an expected decline of 28.9% in 2024, leading the overall market.

As for Nvidia's market performance, Derren Nathan, head of equity analysis at Hargreaves Lansdown, said: "The market has been trying to keep up with Nvidia's improving growth trajectory. Although the current expected P/E ratio is about 35 times, this is not considered a foam area."

According to LSEG data, Nvidia's recent expected P/E ratio is 36 times, while AMD and Intel's expected P/E ratios are 38 times and 21 times, respectively. After more than doubling last year, Nvidia's stock price has more than doubled again so far this year, demonstrating its strong market appeal and growth potential.

At the same time, Microsoft's stock price is also at a historical high, with a relatively moderate increase of about 14% since 2024. Compared to that, Apple's performance is not very satisfactory. Despite a strong rebound in May, Apple's stock price has risen by about 5.6% this year.

Three major milestones in Nvidia's market value

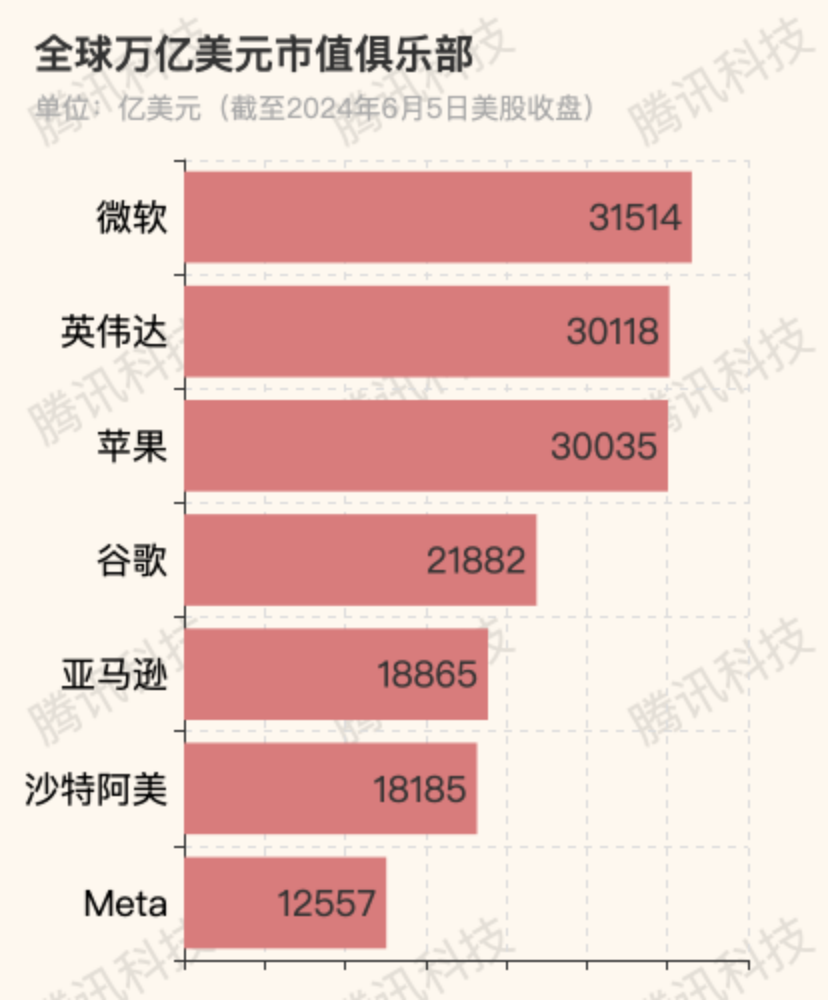

The sustained leap in Nvidia's market value is remarkable. A year ago, the company's market value was less than $1 trillion, after giants such as Google's parent company Alphabet, Amazon, Apple, and Microsoft. In the ranking of the "Seven Tech Giants", its market value is only slightly higher than Meta and Tesla.

However, Nvidia's market value is growing rapidly. By the close of trading on June 13, 2023, its market value has successfully crossed the $1 trillion mark. And by February 23, 2024, it had even surpassed $2 trillion, becoming the company with the fastest market value jump from $1 trillion to $2 trillion. On June 5th, Nvidia's market value exceeded $3 trillion, and it took less than four months to go from $2 trillion to $3 trillion.

On May 22nd of this year, Nvidia's impressive performance drove the company's stock price to continue rising. On May 23rd, Nvidia's stock price broke through the $1000 mark for the first time, with a staggering market value of $2.5 trillion. This milestone is less than a year after its market value surpassed $1 trillion.

Tech giants bet on AI to compete for Nvidia chips

Large tech companies such as Microsoft, Google, and Apple consider artificial intelligence as an important direction for development and have invested heavily in it. Many of the funds were directly used to purchase Nvidia's chips, which undoubtedly provided a strong driving force for Nvidia's growth.

NVIDIA has undoubtedly become one of the biggest beneficiaries of the artificial intelligence boom. The company stated in its latest financial report that its data center division's revenue has skyrocketed by an astonishing fivefold as customers compete to purchase its high-performance chips.

AJ Bell investment analyst Dan Coatsworth explained the soaring stock price of Nvidia as follows: "Nvidia's business development momentum is strong, with broad growth prospects, while the theme of artificial intelligence is still full of vitality and influence. Investors seem deeply attracted to this moving melody and cannot stop

For a long time, Apple stock has been regarded as a blue chip stock on Wall Street, but in recent months it has faced significant challenges. Due to weak demand for iPhones and intensified competition in the Chinese market, Apple's stock price has gradually lagged behind other large technology companies and has continued to decline since the beginning of this year.

Earlier this year, Microsoft surpassed Apple to become the world's most valuable company by early investment in artificial intelligence in cloud computing services.

The rise of Nvidia's stock also benefits from the participation of new artificial intelligence startups, especially xAI founded by Tesla CEO Elon Musk, which has emerged in this industry wide competition. XAI recently received a total investment of approximately $6 billion to develop the next-generation artificial intelligence chatbot Grok, directly challenging competitors such as OpenAI's GPT-4 and Google's Gemini.

Despite criticism that xAI is temporarily lagging behind similar products in terms of technology, the company has demonstrated its ambitious goals by upgrading its new model Grok 1.5. Musk pointed out that in order to train the next generation product "Grok 2", xAI's demand for Nvidia's cutting-edge chips will reach an astonishing 100000. Experts believe that xAI is expected to leverage the massive user data of Musk's social platform X (which has 400 million users) to further improve its artificial intelligence model and provide solid support for its future development.

What challenges does NVIDIA face?

Despite being in a thriving growth phase, Nvidia still faces a series of challenges, including high investor expectations, potential market saturation risks, supply chain instability, and pressure from strong competitors such as AMD and Intel.

Overreliance on the artificial intelligence chip market may lead to fluctuations in Nvidia's stock price due to market demand or technological changes. In order to maintain its leading position in technology and market, Nvidia needs to continue investing heavily in research and development. In addition, the application of artificial intelligence technology may raise public concerns about privacy protection and job loss, which may affect the market's perception and sentiment towards companies such as Nvidia.

However, the surge in demand for artificial intelligence chips is driving Nvidia to continuously innovate and lead technological progress. For investors, Nvidia's sales growth and market dominance are expected to lead to a rise in stock prices, bringing them considerable returns. The rise of Nvidia highlights the transformative impact of artificial intelligence on the market, and its rising stock price marks a shift towards AI driven growth trends.

In a report submitted to clients, Ed Yardeni, founder of Yardeni Research, delved into Nvidia's significant advantages in the rapidly developing graphics processing unit (GPU) technology field and emphasized that "companies seeking breakthroughs and leadership in the field of artificial intelligence inevitably rely on Nvidia's expensive but indispensable GPU chips. ”NVIDIA's carefully designed GPU semiconductor chips are tailor-made to provide strong power for artificial intelligence. Source: Tencent Technology.

Hot News

Hot News